Kaarlo Liukkonen, Otto Kässi and Vili Lehdonvirta

The data centre industry in Finland is booming. According to industry sources, potential data centre investments may add up to 30 billion euros in the next five years. At the same time, the current economic footprint of the data centre industry remains somewhat opaque. Several organisations have published figures on the on the number of data centres in Finland. Yet, these censuses vary, and in our view, they leave gaps: some double-count, others miss entire facilities. To bring clarity, we cross-compared all available sources with media reports and press releases and built our own verified census.

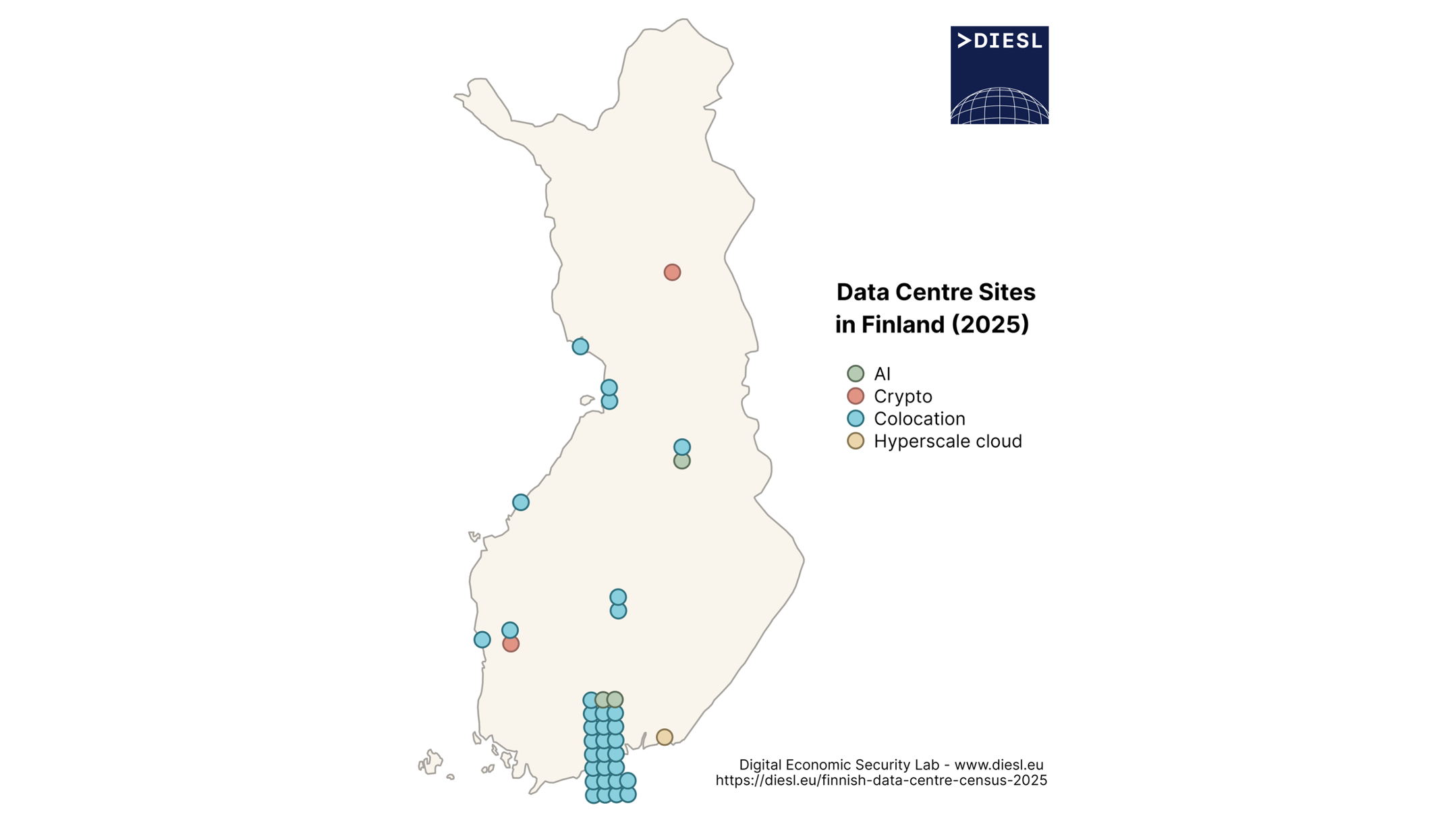

Our initial results show 40 operational data centre sites in Finland. Most (34) of them provide colocation services, selling rack space storage and computational resources to clients. Based on information from public sources, three data centres contain large clusters of AI accelerators (GPUs), which can be used for training large generative AI models. These are LUMI operated by CSC in Kajaani, a data centre operated by Verne in the capital region, and another operated by Nebius in Mäntsälä. Two data centres are purpose-built for mining cryptocurrencies. These are located in in Kankaanpää and Kemijärvi. There is currently one hyperscale cloud data centre site in Finland: Google’s Hamina campus.

Geographically most of the data centres are in Southern Finland. 17 are in the capital city region (Helsinki, Espoo and Vantaa). The data centres are largely operated by Finnish operators, with 18 of them headquartered in Finland. Others come from the United States, Switzerland, United Kingdom, Iceland, Sweden, Germany, the Netherlands, Austria and France.

Electricity demand (the standard measure of data centre scale) is harder to document. Based on public sources, we were able to verify the peak load capacity of 22 of the 40 data centres: 379.5MW. For comparison, Google’s Hamina data centre – whose peak demand we could not verify for our census – alone reported renewable purchases of 255 MW of capacity, before expanding further in recent years. By simple extrapolation, the combined peak load of Finnish data centres is likely on the order of 1 GW. If such a load were sustained continuously, it would correspond to about 8.8 TWh of annual electricity consumption, or roughly 11% of Finland’s total use. In practice, actual consumption depends on utilisation rates and load variation.

Another important aspect of the data centre electricity usage is the price elasticity of demand. Are the data centre operators able to adjust their electricity demand as prices increase, or is the demand effectively constant? A large and inflexible load can amplify the price volatility of retail electricity, especially during winter peaks. The research on this is slim, but existing research suggests that non-cryptocurrency data centres operate with very low short-run price elasticity of demand. The total energy capacity of the two crypto data centres is 5.5 MW, or 1.4% of the total capacity that we recorded. In other words, evidence suggests that most data centre operators hardly adjust their electricity demand based on electricity prices.

To produce this census we drew on data from four sources: S&P Global’s Capital IQ database, Business Finland’s data centre list, Confederation of Finnish Industries’ list of green investments, and the Data Center Map project. We combined these lists and performed desktop research to verify each data point, drawing on data centre operators’ websites, press releases, and reports in news media. We included in the census only those data centre sites that we could very as presently operational based on these public sources.

Download Finnish data centre census 2025.xlsx

We welcome any feedback on the data via email at kaarlo.liukkonen@aalto.fi.